When it comes to preparing for the future, few decisions are more important than securing funeral insurance. For many Batswana like Tumelo, a 51-year-old carpenter and proud father, it’s not just about finances — it’s about dignity, peace of mind, and protecting the ones you love from unnecessary hardship.

But with so many providers and plans out there, choosing the right funeral insurance can feel overwhelming. What’s covered? How much should you pay? Which policy fits your family’s needs best?

In this guide, we break it all down so you can compare funeral insurance plans in Botswana with clarity — and make the best choice for your loved ones.

What is Funeral Insurance (and Why It Matters)?

Funeral insurance is a policy that pays out a lump sum to cover the costs associated with a funeral. This typically includes burial fees, transport, administration, and related expenses.

For families, it means not having to scramble for money during a deeply emotional time. It’s also a powerful way to leave behind respect, not debt.

If you’re a parent or the main breadwinner, funeral insurance ensures your family is taken care of when you’re no longer around.

Types of Funeral Insurance Plans

Different families have different needs. Here are the most common plan types:

- Individual Funeral Cover

Covers just one person — ideal for individuals without dependents.

- Family Funeral Cover

Covers multiple members (usually the main insured, spouse, and children). Often more cost-effective than buying multiple individual policies.

- Funeral Insurance for Parents / Senior Plans

Specifically designed for aging parents or those over 50. Some plans, like Bona Life’s Thebe Funeral Plan, allow you to add older dependents affordably.

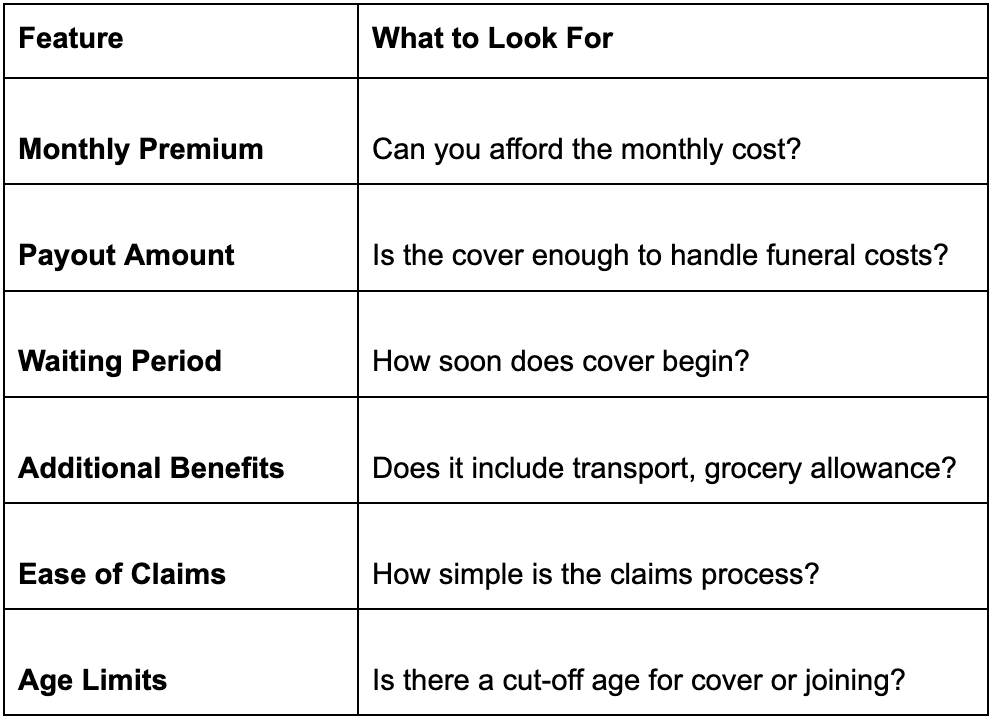

How to Compare Funeral Insurance Plans

Not all funeral policies are created equal. Here’s what to look at when comparing:

💡 What does BWP 50/month really get you?

With Thebe Funeral Plan, a premium as low as BWP 50/month can provide meaningful cover that helps ease the financial burden on your family — with no medicals required.

Key Questions to Ask Before You Buy

- What exactly is covered under this plan?

- Are there any waiting periods or exclusions I should know?

- Is the insurer well-known and trusted in Botswana?

- How does the claims process work, and how fast are payouts made?

Asking these upfront can save you and your family time, money, and stress down the line.

Common Mistakes to Avoid

Avoid these pitfalls when choosing funeral insurance:

- Waiting too long — premiums increase with age, and health issues can disqualify you from some plans.

- Choosing based on price only — cheap isn’t always best if the cover is limited.

- Not reading the fine print — always understand terms and exclusions.

- Not informing your family — make sure someone knows how to access the policy.

Why Thebe Funeral Plan is a Trusted Choice

Bona Life’s Thebe Funeral Plan is designed with Batswana families in mind. It’s affordable, flexible, and easy to understand.

✅ Cover starts from just BWP 50/month

✅ Includes options for parents and extended family

✅ Fast, efficient claims

✅ No medicals required

✅ Backed by a proudly local life insurance provider

It’s more than just a policy — it’s peace of mind.

Funeral insurance isn’t just a financial product — it’s a final gift of care and responsibility. Whether you’re protecting your children, spouse, or aging parents, choosing the right plan today can save your loved ones from unnecessary financial strain tomorrow.

Take the time to compare your options — and make a choice that reflects your love and values.

Ready to protect your family with a plan that fits your needs?

Compare your options and choose Thebe Funeral Plan from Bona Life — affordable, reliable, and tailored for Batswana families.

👉Explore Thebe Funeral Plan here

By Legs Brands