What if your life insurance paid you back?

It’s a question more and more Batswana professionals are asking — and with good reason. Cashback insurance is quickly becoming one of the most appealing financial tools on the market. It offers the peace of mind of traditional life insurance, with the added bonus of getting money back if you don’t claim during the policy term.

Whether you're planning for the future or simply want more value from your premiums, here’s everything you need to know about cashback life insurance — and why Bona Life’s Pula Cashback Plan might be the smart move you’ve been looking for.

What is Cashback Insurance?

Cashback insurance is a type of life policy that refunds a portion — or sometimes all — of your paid premiums if you don’t claim within a certain time frame.

Unlike traditional life insurance, where your premiums are “lost” if no claim is made, cashback insurance policies reward policyholders for staying healthy and maintaining their coverage.

It’s insurance that gives back — financially and psychologically. You stay covered, and if you don’t use it, you don’t lose it.

How Cashback Life Insurance Works

Here’s how it typically works:

- You choose a term (e.g., 10 years) and commit to a monthly premium.

- You remain covered for that term — if anything happens, your family is protected.

- If you make no claim by the end of the term, you receive a cashback payout.

📊 Let’s break it down with a simple example:

Scenario

You pay BWP 200/month for 10 years. That’s BWP 24,000 over the term.

If no claims are made, you may receive up to 20–30% of your total premiums back — that’s BWP 4,800 to BWP 7,200, depending on your policy terms.

🔎 Important to note:

Cashback depends on your payment consistency. Missed premiums, early policy withdrawals, or lapses can affect your eligibility for a payout.

Benefits of a Cashback Insurance Policy

✅ You’re covered either way — If a claim is needed, your family is protected. If not, you get rewarded.

✅ No wasted money — Unlike traditional cover, you see a tangible return.

✅ Boost your financial planning — Cashback can support retirement, emergency funds, or reinvestment.

✅ Encourages consistency — Knowing there’s a return motivates long-term commitment to your policy.

It’s ideal for financially-savvy individuals who expect more from their financial tools.

When a Traditional Plan Might Be Better

Cashback isn’t for everyone. Some may prefer traditional plans if:

- Lower premiums are a priority

- They want higher cover with no savings component

- They prefer pure protection over blended products

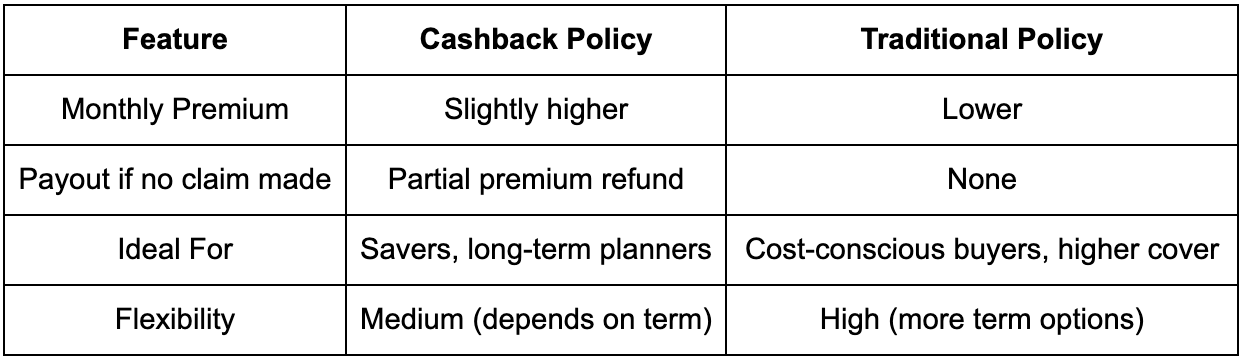

Comparison Table: Cashback vs Traditional Life Insurance

Why Bona Life’s Cashback Policy is Different

Bona Life’s Pula Cashback Life Insurance stands out for its simplicity, local relevance, and fairness.

🔹 Transparent and easy to understand

🔹 Affordable premiums with genuine cashback options

🔹 Backed by a 100% Batswana-owned insurer

🔹 Trusted by families, professionals, and planners alike

Whether you're protecting your family or adding to your long-term savings strategy, this policy offers flexibility with real return on investment.

Looking for a smarter way to stay protected?

With cashback insurance, you don’t just protect your future — you invest in it. It’s a smart way to ensure peace of mind today, with financial rewards down the line.

If you’re ready to make your money work for you, Bona Life’s Pula Cashback Plan is worth a closer look.

👉 Click here to get started

Evan Hamlyn, Legs Brands