Not all lives are the same—so why should all insurance policies be?

A civil servant in Gaborone, a small business owner in Maun, and a breadwinner in Francistown each face very different financial responsibilities. That’s where insurance policy riders in Botswana come in. Riders allow you to customize your policy to suit your unique family, health, or career needs.

In this blog, we’ll explain what policy riders are, why they matter, and how you can use them to build smarter, more flexible protection with Bona Life.

What Are Policy Riders?

Riders are optional life insurance add-ons that enhance your base policy. They act like upgrades—providing extra protection or benefits in specific scenarios that aren’t covered by the main plan.

Think of them like “power-ups” for your insurance. For example, your standard Lefa Life Insurance Plan may provide essential life cover, but with a rider, you could add critical illness protection or accident cover. This flexibility means your policy adapts to you, not the other way around.

Why Riders Matter in Botswana

Batswana households often carry dual responsibilities: raising children while supporting aging parents. A funeral insurance customization rider allows families to include cover for additional members, easing financial strain during difficult times.

For entrepreneurs or professionals who rely heavily on their income, riders such as income protection or a critical illness cover can safeguard against sudden financial shocks. In a country where extended families often rely on one breadwinner, riders provide peace of mind by preparing for life’s “what-ifs.”

Examples of Common Riders

Here are some of the most popular policy riders explained:

- Accidental Death Rider: Provides an additional payout if the insured passes away due to an accident.

- Critical Illness Rider: Offers a lump-sum benefit if diagnosed with illnesses such as cancer or stroke.

- Waiver of Premium: keeps your policy active even if you become disabled and can’t pay premiums.

- Child/Parent Funeral Cover Add-on: extends your Thebe Funeral Plan to cover parents or children, ensuring wider family protection.

- Cashback or Savings Rider: available with plans like the Pula Cashback Plan, this rider returns a portion of your premiums if no claim is made, adding long-term value.

How to Choose the Right Rider

When selecting riders, consider the following:

- Life stage – Parents with young children may prioritise education or funeral add-ons. Older adults may focus on critical illness or retirement-linked riders.

- Budget – While riders do increase your premium, the additional cost is often small compared to the financial relief they provide.

- Advice & flexibility – Speak to a Bona Life advisor to match your policy with your goals. Regular reviews can help you add or remove riders as your life evolves.

Choosing custom insurance coverage ensures your policy grows with you.

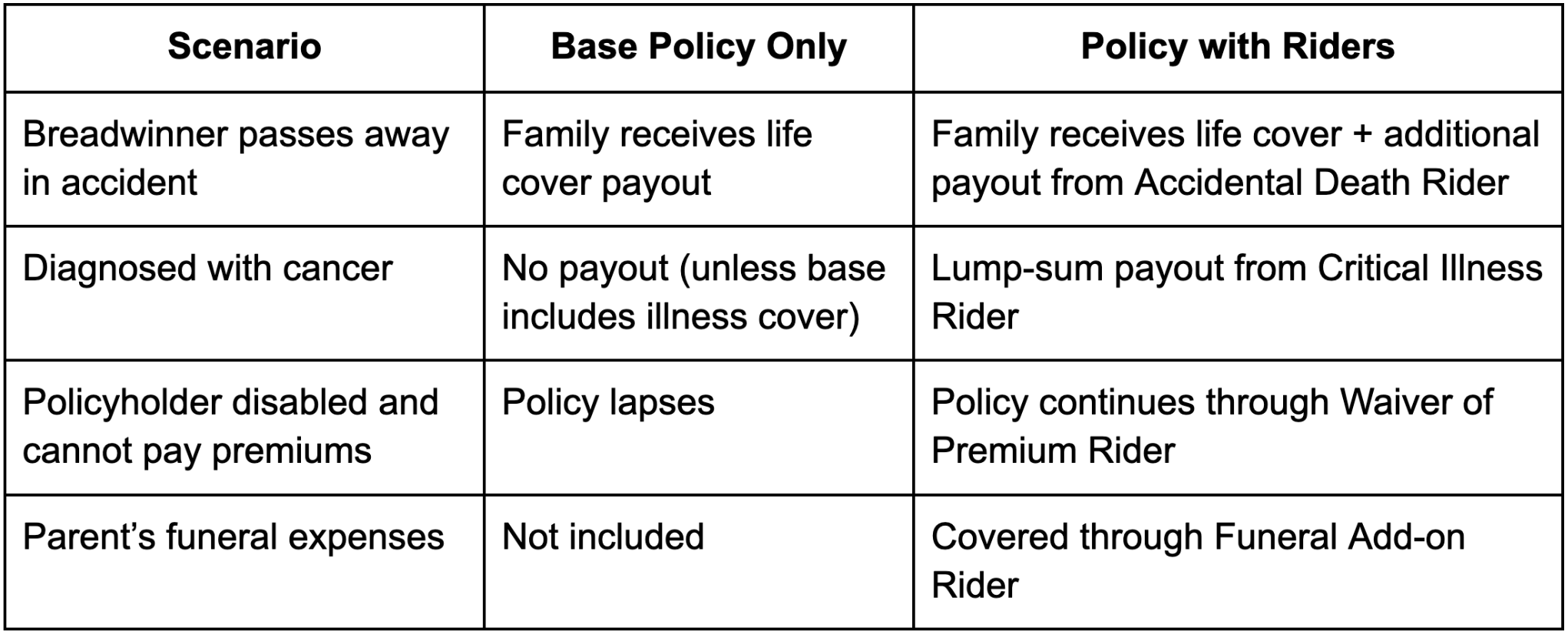

Comparison: Base Policy vs Policy with Riders

FAQs on Policy Riders

Can I add riders later?

Yes, most riders can be added when you review your policy—though it’s often cheaper to include them upfront.

How much more do riders cost?

Riders increase premiums slightly, but the value they provide during emergencies often outweighs the cost.

Are riders permanent?

Not necessarily. Riders can often be adjusted or removed as your circumstances change.

Take Out

Life is unpredictable—but your insurance doesn’t have to be. Insurance policy riders in Botswana give you the power to personalise your policy, making it stronger, more flexible, and better suited to your real-life needs.

Whether it’s protecting your income, supporting your parents, or preparing for health challenges, Bona Life helps you design insurance that truly fits your life.

Want insurance that fits your life perfectly? Speak to a Bona Life advisor about adding riders to your policy today.

📞 Call: +267 398 1800

📱 WhatsApp: +267 76 744 686

🌐 Visit: www.bonalife.co.bw