What is group life insurance, and why should your business consider it? Group life assurance is more than just a staff benefit—it’s a strategic investment that protects your employees and powers your business’s growth. As companies in Botswana compete for top talent and aim to foster loyalty, offering group life assurance benefits can set you apart and strengthen your workforce. In this blog, we’ll explain what group life assurance is, how it works in Botswana, and the seven key benefits you might not know about.

What is Group Life Assurance?

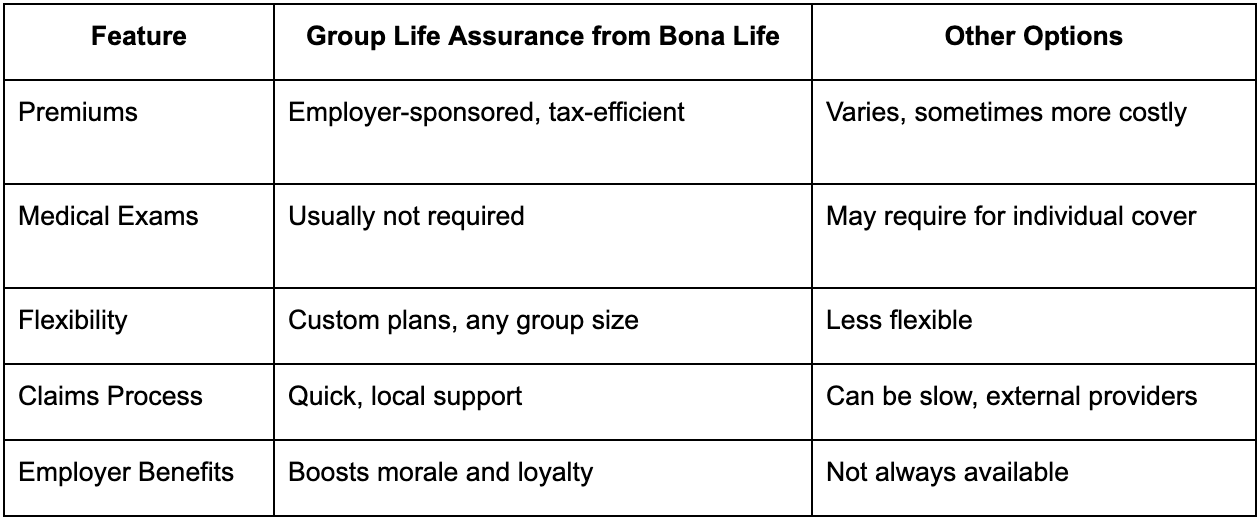

In simple terms, group life assurance is an employer-sponsored insurance policy that provides a lump sum payout to an employee’s nominated beneficiary in the event of their death. In Botswana, this is a popular way for employers to support their staff’s families and demonstrate a commitment to their well-being.

Here’s how it works: The employer pays the premiums, often at a discounted group rate. Coverage applies to all eligible employees, ensuring broad protection, and beneficiaries—usually family members—receive a payout if the employee passes away.

Group life assurance typically covers a standard payout amount but can be customized based on employee roles or salaries, depending on the scheme chosen.

7 Key Benefits You Didn’t Know About

Investing in group life insurance offers more than just peace of mind for your employees. Here are seven strategic advantages your business might not have considered:

- Boosts Employee Retention

- Offering group life assurance signals that you care about your staff’s welfare, which increases loyalty and reduces turnover.

- When employees feel valued and protected, they’re more likely to stay longer, saving your business on recruitment and training costs.

- Attracts Better Talent

- In a competitive job market, benefits like group life assurance position you as an employer of choice.

- Top candidates often compare total compensation packages, and a robust insurance plan can give your company the edge.

- Tax Benefits for the Employer

- Many businesses can take advantage of tax efficiencies or deductions related to group life assurance premiums.

- Check with your tax advisor or financial consultant to explore how group life insurance Botswana can align with your tax strategy.

- No Medical Exams for Employees

- Most group life assurance schemes do not require medical exams, making it easy to onboard cover for all staff members, regardless of their health status.

- This ensures that everyone is protected without administrative delays.

- Flexible Group Sizes and Custom Plans

- Whether you have 10 employees or 1,000, Bona Life offers flexibility to match your business needs.

- Custom plans can be designed to fit the unique structure of your company, ensuring that every team member feels secure.

- Enhances Staff Morale and Loyalty

- Knowing that their families are financially protected makes employees feel appreciated.

- This leads to a more engaged, motivated, and loyal workforce—an essential ingredient for business success.

- Quick and Simple Claims Process

- When tragedy strikes, Bona Life’s efficient and reliable claims process ensures that benefits are paid promptly.

- Our local presence in Botswana means hands-on support when your employees’ families need it most.

How Bona Life Supports Employers

At Bona Life, we understand that every business is different. That’s why we bring years of expertise in managing group life assurance schemes and employee benefits Botswana with a local touch. Our team offers tailored advice, flexible plan design, and a proven track record in delivering reliable protection for employees and their families. From small businesses to large corporations, we’re here to support your goals.

Group life assurance is more than an employee benefit—it’s a smart, strategic move that protects your people and powers your business forward. By investing in group life assurance botswana, you not only show your staff that you care, but you also strengthen your company’s competitive position in Botswana’s job market.

Want to protect your team and your business?

By Legs Brands